We humans are a clever lot. We figured out long ago how to bring automatic control to machines and systems of all kinds, and we used this control to change the world.

The rapid growth of industrial civilisation was driven in a very large part by steam engine technology, and central to this new technology was a simple device that brought automatic control. The pressure regulator for steam boilers prevented the pressure from rising to the point where the engine would inevitably explode, without a human engineer working the valves. It was simple, and it was genius, and it helped to drive the transformation of the world’s economy.

We need another transformation of the world’s economy. We need to make a transition from a system that depends on infinite energy, infinite growth and infinite resources, to one that can operate effectively in a world without abundant cheap energy and with a set of unavoidable limits on economic expansion.

To make this transition we will need to take control of certain economic outcomes, but we humans have never truly figured out how to control outcomes delivered by the global economy, the most powerful machine ever constructed. That is, until now.

We have a solution, and just like the pressure regulator, it is a fairly simple but ingenious control mechanism. The pressure regulator was a control system that allowed us to better harness the energy in the very abundant coal resources at the time, and we exploited it to power the Industrial Revolution.

A control system for the global economy will allow us to better preserve what remains of our natural resource base for as long as we choose. It will harness the inherently innovative and competitive engine of profit-seeking markets, and exploit them to grant us the power to make the transition we need.

A control system for the economy would also grant us the freedom to decide what economic outcomes we want, above and beyond the simple goal of the sustainability of human civilisation, and give us the power to make markets rush to deliver those goals.

Before we can go on to explore the design of this economic control system, it is critical that we first fully understand exactly why a transformation of the economy is needed.

Change of mindset

The presumption of infinite economic growth is etched very deeply into our collective consciousness, and is currently central to the disciplines of finance and economics that dominate the economic and political system on a global scale. The presumption that growth can continue indefinitely must be thoroughly debunked, beyond a shadow of a doubt.

The presumption that growth can continue in the short term at least, say for another 30 years, must also be debunked beyond all doubt. We cannot afford to indulge in the comfort that comes with such a complacent view. We cannot afford to waste the energy and resources necessary to make the required transition. Even another 10 years of business as usual will dramatically deplete our capacity to achieve what is necessary for sustainability, and desirable for social outcomes. We have to act now.

Our minds will only be truly open to the solution when we fully accept that this is the time to make the necessary change of mindset, from pursuing growth to pursuing prosperity and sustainability. The sooner we can understand and accept everything that is wrong with the system as it stands, the sooner we can go about fixing it.

Fortunately, there are excellent resources available that can help us reach that understanding quickly and easily.

Accelerated Crash Course

The video we are about to explore is simply brilliant. It lays out almost everything we really need to know with a very clear presentation.

Chris Martensen was once a highly successful businessman, and the vice president of a Fortune 500 company. He has since simplified his once extravagant lifestyle, worked to build genuine connections with community instead, and dedicated the last 10 years of his time and effort into developing and refining the ‘crash course’, an online series of video lessons about the impending end of economic growth, and the trajectory towards disaster we are currently following. The online course includes over 4.5 hours of video material, and this accelerated version summarises it all in under an hour, which shouldn’t be too much to ask of readers.

There is one very important thing to keep in mind while watching the video: we do have an alternative to the financial system we have at the moment. In other words, finance can be fixed. Readers who have already absorbed the Fixing Finance article here will know this, or will at least be well aware of the argument. Finance can be challenging and even daunting for people to get their head around, so for those not really familiar with the money system it is probably much better to watch this video first.

The video does make the point that it is explaining how things are under the current system design, so just try to keep in mind that while we can’t escape the reality of our current situation explained so well in the presentation, there are certainly things we can do to change our future trajectory.

Please watch up until the highway sign that points to Doom and Gloom at the 47 minute mark and then continue reading below:

Before we can progress to explain how to fix the economic system, we need to make sure that readers are all on the same page in terms of what is wrong with it, and why we need to fix it. So in the next section we will simply list the main points made in the video, and use some quotes and brief explanations to support them.

If you understand and accept a point of the argument, you can nod or give it a mental tick mark, and simply ignore the details and move on to the next point. If you don’t understand a point, even after reading the detail and reviewing that section of the video, you can ask a question via a comment. If you don’t agree with a point, you can make a rational challenge, also via a comment.

These are the foundations on which the next part of the argument to come is based, so it is important to understand and accept them all:

The essential truth

Massive change is upon us. Most of us are becoming more aware that something is quite wrong with the economic system as it stands, even if some cannot point their finger at the precise problems and the cause and effect at play. Taken together, the list of points here constitute a fairly complete grasp of our true situation. If you can understand all of these points, accept them all, and remember them all, then you will become one of the relatively few people on the planet who truly comprehends that we must make a choice between prosperity and collapse. You will agree that we must start a transition from a system based on the presumption of growth, to one based on prosperity and sustainability. You will know that the sooner we start that transition, the more prosperous our future can become.

You will be armed with an argument that cannot be rationally challenged, and you will be ready to embrace the world’s best possible approach to fixing the system. As the video states in the introduction:

Knowledge is power. Martensen spends a few minutes trying to make sure that people fully understand the exponential growth curve, and rightly so, because we humans are prone to thinking in linear terms, when almost nothing is linear in the real world. Things that are growing exponentially may appear to be growing gradually, along an approximately linear path for a long period, and it is only natural for us to presume they will continue on the same linear path into the future.

But as we now know, most of the perceivable effects of exponential growth play out rapidly, as the last of the available resources are consumed in vast quantities, until there is no more fuel for growth. Without fuel, there can only be collapse and death. So it is critical that we throw off linear thinking and the complacency that comes with it, and start to see exponential growth as ultimately destructive. So the next point to add is:

Exponential growth leads to sudden collapse. With exponential growth, the action really only heats up in the last few moments. There is simply not a lot of time left once you hop upon the vertical portion of a compound graph. Time gets short.

Economy

We have an exponential money system. It must grow in order to work as it has been designed to. With such growth, our financial system behaves well, and without such growth, it weakens and threatens collapse. The central problem we face is really that simple, and that profound. As any sixth grader can tell you, nothing can grow forever in a finite space.

An exponential money system must collapse. Our money system is built for a world without limits, which means it is built for something that does not exist. That requirement for ever increasing economic growth is now encountering very real limits.

There is no combination of policy tweaks, spending cuts, or investment that will allow our system – as it is currently designed – to run forever, or even that much longer, historically speaking.

Money is not real wealth. There are three levels of wealth, that can be thought of as a pyramid shape. The bottom layer of the pyramid is our natural resource base, which is made up of all the natural resources and natural systems our world contains, and this can be considered Primary wealth. The second layer built upon that resource base contains all of the goods and services that have been made available for consumption by transforming some of those resources, and this is Secondary wealth. These bottom two layers of primary and secondary wealth can be considered real wealth.

At the top layer of the pyramid is Tertiary wealth. This consists of money, derivatives, stocks, bonds, and other financial instruments. Tertiary wealth is only a claim on sources of wealth; it is not a source of wealth itself. The distinction is vital. Without primary and secondary wealth, tertiary wealth has no value. Without the bottom two layers of the pyramid, the top layer cannot exist.

Money must match the real world. As long as money exists in a delicate balance with actual sources of wealth, then it will retain its perceived value. In times when money is overabundant, or resources are scarce, the relationship can and usually will change dramatically. The result will be hyperinflation, or debt deflation, depending on the circumstances. This process is usually referred to as ‘wealth destruction’, but those paying attention will know that wealth is not being destroyed, it is only being transferred from the unwary to the wise.

All dollars are loaned into existence. Governments borrow money from markets by issuing bonds, which they subsequently pay back with interest. Far more importantly, when the private banks create loans, they summon money and debt out of thin air, and 99% of the money in circulation has been created by this process. Both public spending and private lending currently involve the creation of money as interest bearing debt.

The video does not mention or explain the private side of money creation, so for further explanation see this section of another article on this site: Finance for beginners.

Money and debt both grow exponentially. Our money supply, even with the wiggles and jiggles along the way, 2008 included, has been growing exponentially. And not just sort of, but almost perfectly.

[Chart: Total credit market debt, US excluding government liabilities, 2014]

There is always more debt than money. We see the exact same trend as the previous money chart, except that the left axis goes all the way up to $57 trillion. Remember our money graph only went to $12 trillion. Neither of these results should surprise you, because remember money and debt are created in the same system at the same time. That is an exponential system by design, and there is always more debt than money.

US government debt is unsustainable. US government debt shows a marked acceleration over the past 12 years. If you are thinking that the US can just continue to borrow from the rest of the world, on this trajectory forever, have I got news for you. The rest of the developed economies are just as broke as the United States, and some are even more so.

The debt of other OECD countries is unsustainable. The world’s economies are carrying over 375% of debt, as compared to their gross domestic product, or GDP… If the total amount of debt is what a nation owes, then its GDP is its income.

In all of history we have exactly zero examples of any nation of ever climbing out from a debt load of greater than 260% as compared to GDP.

Global debt cannot be repaid by international lending. If everybody owes everybody more than has ever been owed by any individual country before, in which parallel universe is it possible for countries to lend each other back to financial health?

Global debt cannot simply be forgiven or forgotten. [Real people and businesses would bear the costs, and the flow on effects would likely be devastating… ]

Global debt cannot be repaid by infinite economic growth. The only real option, the one presented to us in virtually every news article and political utterance, is economic growth. It is through the miracle of economic growth, vast, huge, enormous, unspecified but certainly dramatic economic growth, that all of this debt and money are supposed to be paid back.

Well there is just one wrinkle with that story. Gross domestic product, or GDP, is what you and I might more casually call the economy, and that can not grow exponentially forever, unless it has access to infinite resources.

Limits to economic growth represent a critical and immediate problem. The primary fuel for growth, the most important one of them all, is oil, and it is now, and forever more, going to be expensive compared to the past, and even more expensive as we progress into the future.

Energy

Energy is the ultimate limit to growth. In natural systems … Everything grows larger right up to the limit of the energy it has available to it.

No energy, no economy.

Economic growth depends on exponential growth of oil production. 95% of everything that moves from point A to point B in our global economy does so because of oil.

Oil is the most important resource of all for a growing economy. Oil is the master resource.

Over the last 50 years, every 1% increase in GDP required roughly a 1/4% increase in oil production.

We are past the point of peak cheap oil. Oil is no longer cheap, but expensive, and will stay that way.

Expensive oil tells us that there is simply less leftover surplus to fuel the global economy. Just as importantly, our ever growing piles of money and debt are implicitly assuming that there will always be a larger economy to match them against, and that assumes that there will always be more net oil and energy in the future. This is a colossal bet, and if it turns out to be wrong, if the premise itself is incorrect, then Houston we have a problem.

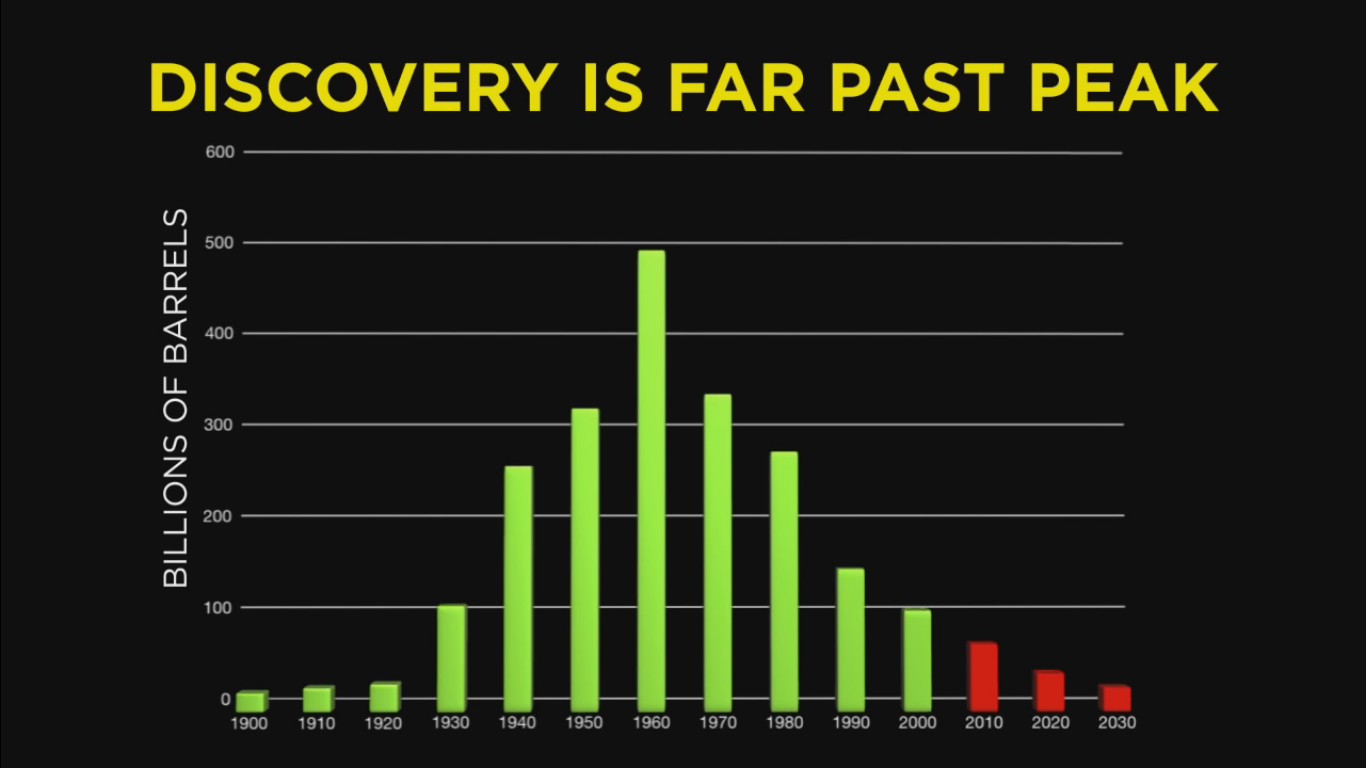

Oil discovery peaked in the 1960s. This oil that we found back then was all cheap oil, located near the surface and freely flowing, no fracking required.

Net energy from oil extraction is dwindling. Give or take, there is roughly the same amount of oil being produced globally today as there was in 2005, only we are spending twice as much in getting it out of the ground.

Less net energy means the end of growth. The really big predicament here is that our entire money system, including all the debts and the currency, as well as all the unfunded liabilities, can be met if and only if we have sustained permanent economic expansion. When the time comes to admit that we cannot have sustained permanent economic expansion, we will also have to admit that we cannot grow our debt levels any further.

These are all very big, very powerful trends that are here right now, and anybody can Google up the data and see it for themselves

Environment

Waste streams into ecosystems are growing exponentially. The increasing demand of exponentially more resources being extracted from the ground, and exponentially more waste being put back into various ecosystems.

Critical resources are being depleted just like oil. Oil is not the only essential resource that is fast becoming harder to find, more expensive to produce, or both.

In fact we see an alarming number of examples of depletion of critical resources that almost exactly mirror the oil story. First we went after the easy and or high quality stuff, then the progressively trickier, deeper and or more dilute stuff.

The story here is that we, as a species, all over the globe, have already mined the richest ores, found the easiest energy sources, and farmed the richest soils that our Environment has to offer.

Lower ore grades mean more energy and cost. The amount of energy and money that is required to extract any mineral or metal is a function of the ore grade.

Now we have things like the Bingham Canyon mine in Utah. It is two and a half miles across and three-fourths of a mile deep, and it started out as a mountain. It sports a final ore concentration of 0.2%. Do you think we’d have gone to this effort if there were still massive copper nuggets lying around in stream beds? No way.

We’ve already high-graded all the other known ore bodies… after only 200 years of pursuing an industrial economy, we’ve already burned through all the better grades.

Critical resources cannot be replaced. We have taken several hundreds of millions of years of natural ore body, fossil energy deposition, aquifer accumulation, soil creation, and animal population growth — and largely burned through them in the few years since oil was discovered. It is safe to say that in human terms, once these are gone, man, they’re gone.

The economy is destroying real wealth to create not-real wealth. So, if we are getting less and less net energy for our efforts, and the other basic resources we need to support exponential economic growth are requiring a lot more energy to extract because they are depleting, then does it make sense to keep piling up exponentially more money and debt? Isn’t it just common sense to observe that money and debt have to exist in some sort of relationship and proportion to primary and secondary wealth?

We saw earlier that “without primary and secondary wealth, tertiary wealth has no value.” In other words, the longer we have economic growth, the more depleted our real world becomes, the less goods and services can be created and delivered, and the more rapidly money and other claims to underlying real wealth lose their value. We are already massively oversubscribed, much like we are all frantically collecting ever more tokens to bid for prizes in an auction, while failing to realise that very soon there will be nothing left to bid on, and so the tokens will be worthless.

Money is not wealth. To consume the real world in the race to accumulate money is not logical and not sustainable; it is a form of collective madness or psychosis.

Prosperity versus Growth

Growth is the destructive pursuit of ‘More’. Growth requires energy. And growth also requires that there be an excess of stuff that can be dedicated to the effort. The basic ideology of growth can be summed up in one word – More.

Prosperity is satisfaction with ‘Enough’. But to be prosperous, you at least need Enough. All of the developed world’s bond and stock markets are priced with the implicit and explicit assumption baked in that there will be continued future growth in the economy, corporate earnings, money supply, debt and all the rest. … But what if that growth never arrives? What then?

More growth = Less prosperity. If we do not properly allocate our dwindling surplus resources towards prosperity, and instead default into the comfortable and familiar pattern of growth, which will someday stall and then go into reverse, then we risk a future of less prosperity. [Given that the process has to go into reverse at some point, the risk is absolutely certain, so it is better to say that continuing growth will guarantee less prosperity.]

Growth is the ignorant option. It is our future prosperity that we place at risk if we allow ourselves to do what is easy – that is, take the path of least resistance and simply grow – instead of doing what is right, which is directing our surplus towards a more prosperous future.

More ominously, if we do not get this story right, we risk a major economic decline, a future simply filled with less instead of prosperity, and the possibility of a currency crisis, if not collapse.

Prosperity is the enlightened option. This, then, is the greatest challenge of our times – properly recognizing where we want our remaining resources to go and then making that happen.

I, for one, want to see continued advances in energy efficiency, medical technology, and everything else that modern society can offer.

I want my children to have reasonable and fulfilling jobs, and I personally would vastly prefer to live in a world of happy and prosperous individuals versus one that is merely larger, but with less to go around for each person.

Accepting reality means abandoning growth. Our Economy is based on an exponential money system that explicitly enforces a paradigm of continuous growth and implicitly assumes that the future will be much larger than the present.

Growth requires Energy; there is no getting around that; so the trends in Energy stand in stark contrast to the major underlying assumptions upon which our entire economy and way of life are founded. Peak Energy is a very real, very close prospect.

In the Environment we see, very clearly, that we humans have high-graded virtually every resource and are now working our way into poorer, thinner, deeper territory as we seek the resources that define our lifestyles. Biosystem stress is flashing warning signs on our dashboard. Pretending that we can just carry on consuming as we have, while the world population increases by 50% over the next 40 years, is not a workable plan. In fact, it is no plan at all.

Accepting reality means pursuing prosperity instead. Our economy must grow to support a money system that requires growth, but is challenged by an energy system that can’t grow, and both of these are linked to a natural world that is rapidly being depleted.

Taken all together, it becomes quite clear that our challenge is to adapt to a world of less, not more. A world where we have to carefully prioritize and manage what we have left, versus hurriedly pursuing the next lower grade of resources to exploit.

Summary

Now that you are armed with this powerful and important argument, you are going to want to share it, and hope to persuade others to inform themselves and abandon any complacency or ignorance. There is a full transcript of the video here, and you can use it to copy other quotes in your arguments and comments.

The following paragraphs provide a summary of all the points listed here, and should make it easier to quickly express the big picture argument when debating in other online spaces. For example, you can copy one paragraph and paste it in reply to someone who does not accept your view, and ask them to identify which points in particular they do not agree with.

Economy: Exponential growth leads to sudden collapse. We have an exponential money system. An exponential money system must collapse. Money is not real wealth. All dollars are loaned into existence. Money and debt both grow exponentially. There is always more debt than money. Exponential growth has reached its limits. US government debt is unsustainable. The debt of other OECD countries is unsustainable. Global debt cannot be repaid by international lending. Global debt cannot simply be forgiven or forgotten. Global debt cannot be repaid by infinite economic growth. Limits to economic growth represent a critical and immediate problem.

Energy: Energy is the ultimate limit to growth. Economic growth depends on exponential growth of oil production. We are past the point of peak cheap oil. Oil discovery peaked in the 1960s. Net energy from oil extraction is dwindling. Less net energy means the end of growth.

Environment: Waste streams into ecosystems are growing exponentially. Critical resources are being depleted just like oil. Lower ore grades mean more energy and cost. Critical resources cannot be replaced. The economy is destroying real wealth to create not-real wealth.

Prosperity: Growth is the destructive pursuit of ‘More’. Prosperity is satisfaction with ‘Enough’. More growth = Less prosperity. Growth is the ignorant option. Prosperity is the enlightened option. Accepting reality means abandoning growth. Accepting reality means pursuing prosperity instead.

The end of the Industrial Revolution

For another perspective, some readers may prefer this excellent video, which explains the same big picture reality as Martensen’s crash course, but with a more concrete and detailed explanation of limits to growth imposed on the mining sector.

There is a compelling argument against nuclear energy being able to extend the period before Peak Energy really starts to limit our industrial activity, and a great summary of how the various real world constraints add up to the necessary end of materialism and industrial civilisation.

The Industrial Big Picture

Peak Mining =

- Decreasing grade +

- Decreasing grind size +

- Increasing depth +

- Peak fossil fuel +

- Expansion of production needed to stay viable

Peak Finance =

- Sovereign debt default +

- Fiat currency devaluation +

- Credit freeze +

- Structural inflation +

- Expansion of money needed to service debt

Peak mining means that we are no longer going to have available raw materials, and peak finance means that we won’t be able to pay for them. Putting these two realities together means we have Peak Manufacturing.

Put peak manufacturing together with peak energy, and the idea that we have a credit freeze, meaning that we don’t have the capacity to pay for stuff, especially big stuff, means that we have Peak Industrialisation. In other words, we are not going to see projects like the Hoover Dam any more; we just won’t be able to do it.

Put peak manufacturing together with peak industrialisation and we have The End of The Industrial Revolution and the End of Materialism.

The solution

The economic control system will be fully explored in a coming post. The Global Carbon Sinking Fund proposal on this site presents an outline of how the economic control system could be used to deliver the singular goal of controlling greenhouse gas concentrations on the global scale.

Please consider and debate the points presented here as the essential truth of our situation. The intent of this article is to draw out the series of assertions made in the video, and express them explicitly so that each one can be challenged. If you can challenge any of them, then the comments section here is the place to do it. If you have questions, this is the place to ask them. If you understand and accept all the points and the overall argument, and hadn’t already before exploring this resource, then congratulations are in order because you are now very well informed about the true nature of our situation, and you are no doubt eager to move on to exploring the solution.

At the end of the video, Chris Martensen asks viewers to share this video with 3 people that you care about. I have done this by exploring it here, so please do the same with this article or the Accelerated Crash Course video. If you use social media, then please find a place to at least mention this article. It certainly can’t hurt to let others see that you are willing to explore the big picture, and it will help the search engines to make more connections between people and this important subject.

A reminder that finance can be fixed, and must be fixed if we are to make progress towards prosperity and sustainability. The argument in the Fixing Finance article is comprehensive, and contains some excellent resources, which might help even beginners to have a better grasp of the subject than most economists. There is a lot to absorb, perhaps more than can be taken in with just one reading, so please don’t be daunted and give it a go.

Thanks for reading.

Review article section: Accelerated Crash Course, The essential truth, Economy, Energy, Environment, Prosperity versus growth, Summary, The end of the Industrial Revolution, The solution

Just a couple of misconceptions need to be addressed to keep macroeconomics on track to fit with reality. “All dollars are loaned into existence” NOT TRUE! All dollars are created by law out of thin air by spending,

Any monetary sovereign government has clauses in its constitution giving it total control of the national currency. This means the government can a] never go broke and b] never run short of its currency. c] never needs to save or borrow its own money. As long as resources are available to buy it can create currency. d] Taxes do not fund the government spending. There is no need when there is a ready source of freely available currency. Taxes extinguish currency – excess currency.

Banks create most of the money supply as credit and it becomes currency which is extinguished when the loan or mortgage is paid back. Tax does effectively the same.

So to take advantage of this the government doesn’t have to cut any spending because the tax take is too low, and initiatives, like roads and dams and soil improvement can be undertaken without a need to borrow for them. Same for health and education. It can all be free.

Note this only applies to the national government, not local or state governments who have to earn or borrow money for their jobs.

Hi John. Welcome to the site.

I am not going to allow a protracted discussion about MMT on this thread, but I will let your comment stand, and say that I agree with it except for the first paragraph.

In Australia, the US, and the rest of the Anglosphere, around 99% of the money supply was created as credit, in the process of private banks issuing loans. So those 99% of dollars are certainly loaned into existence.

On the public sector side, governments issue bonds to match new spending, and these bonds come with an interest bill too, so public spending is financed by borrowing from the private sector. So the remaining 1% of dollars that make up the money supply are also loaned into existence.

The rest of your comment is fine, although it would be more appropriate on the Fixing Finance article. Cheers.

For other readers, further comments on this thread about MMT will be deleted, so please don’t bother. But do read the Fixing Finance article, and if you can make a civil and rational case against sovereign control of the money supply, then feel free to do so there. It might even help to start some interesting and constructive debate.

Artikel yang sangat bagus …

Ulasan informasi yang disampaikan sangat bermanfaat …

Terimakasih informasinya min …

Ditunggu artikel selanjutnya …

Salam kenal …

how Fixing Economics?

A fair question I guess.

Fixing the economy requires a thorough understanding of the set of problems, which is what this post is all about, and then engineering a solution that will address those problems at their root cause.

As already mentioned, the solution has two parts, the first being to make the financial system sustainable by controlling the money supply, as detailed in the Fixing Finance article, and the second being to add a control system to the economy to make it deliver a defined set of goals.

The control system needed is demonstrated in the Global Carbon Sinking Fund article, although it is really in a draft form and needs more examples, demonstrations and deeper explanations.

While careful not to make any promises, I intend to add a full article about an economic control system called something like: Supercharging the Economy with a Goal Delivery System.

If any readers are willing and able to critique or question the argument in the carbon sinking fund post, then comments on that thread might help to speed up the argument development and improvement process.